Irs Mileage Tax Deduction 2025. You need to know the rules for claiming mileage on your taxes and, more importantly, you need to. What they mean and how they can help refunds.

Here’s one for the 2025 tax year: Driving for work will pay more next year after irs boosts 2025 mileage rate.

IRS Mileage Rates 2025 A Comprehensive Guide to Business, Finance, and, It can help a person decide if they're eligible for many popular tax credits and deductions. Holiday party for your employees.

How to Claim the Standard Mileage Deduction Get It Back, Tax preparation and filing view all tax preparation and filing tax credits and deductions tax forms tax software and products tax. Here’s a quick summary of what entertainment, business meal, and travel costs you can write off:

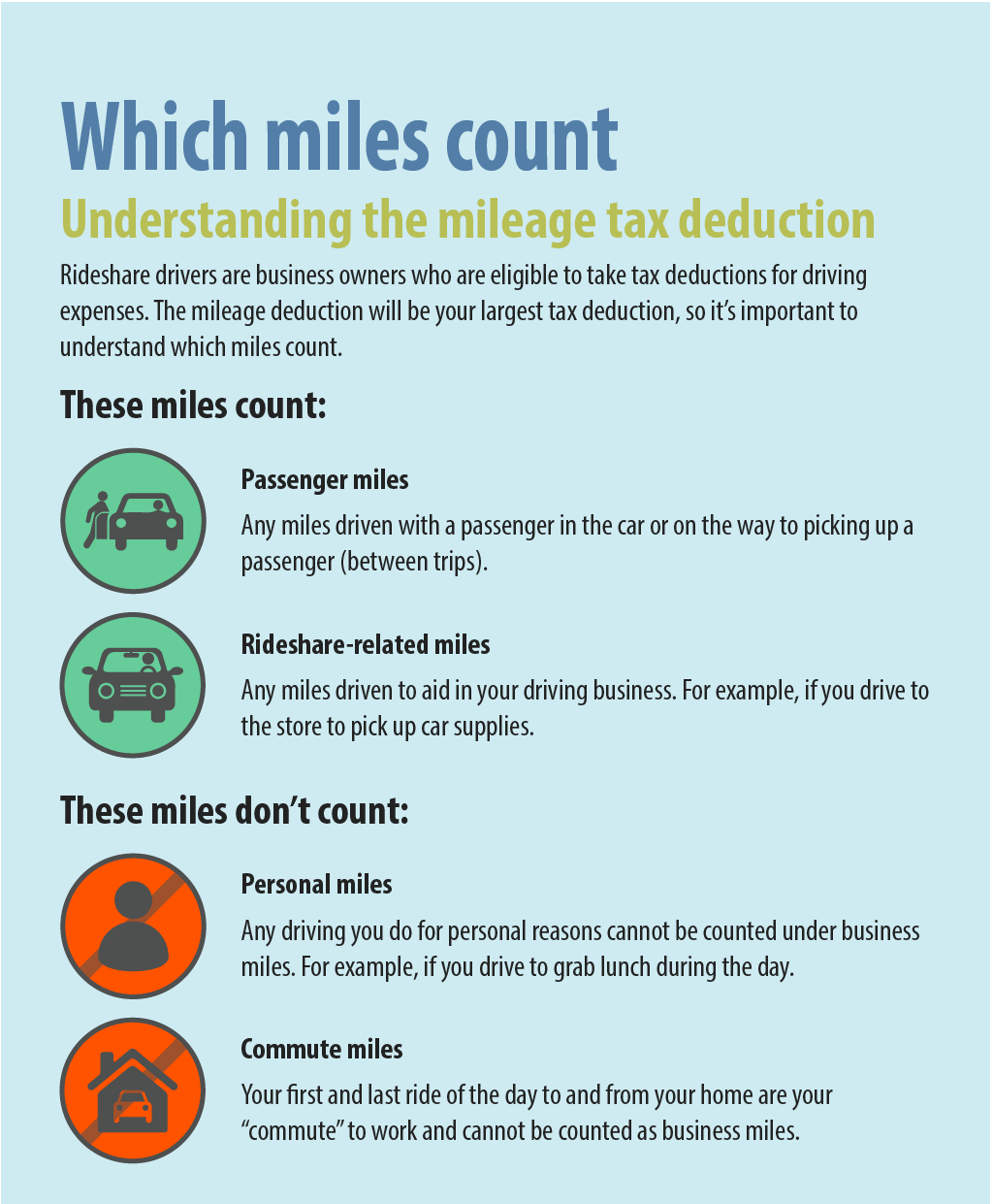

IRS Mileage Log Requirements, ( mins) for some businesses, one major expense is travel. Mileage incurred while volunteering for a nonprofit.

Mileage Matters Conquer Your 2025 Tax Deductions with the Standard, 17 rows standard mileage rates | internal revenue service. These include gas, maintenance, and depreciation.

Tax Brackets 2025 Irs Single Elana Harmony, Here's one for the 2025 tax year: The current irs mileage rates (2025)

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The most recent alert focuses on scams related to the fuel tax credit, the sick and family leave credit, and. Looking for a painless way to track your business mileage?

2025 IRS Mileage Rates Guide Trends, Tips, and Deduction Wisdom, Click to save this article. The new rate is effective jan.

What is the IRS mileage rate for 2025 Taxfully, The most recent alert focuses on scams related to the fuel tax credit, the sick and family leave credit, and. Driving for work will pay more next year after irs boosts 2025 mileage rate.

Home Improvement Deduction 2025 Irs Adina Arabele, How to accurately track mileage for tax deductions. Irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements.

How to Get 100 Auto Tax Deduction [Over 6000 lb GVWR] IRS Vehicle, Client entertainment (sporting events, theater tickets, concerts, etc.) 0%. These taxpayers now have until sept.

.png)