Car Bonus Depreciation 2025. For 2025, that rate is $0.655 (65 cents) per mile. The irs has released (rev.

For 2025, that rate is $0.655 (65 cents) per mile. For 2025, businesses can take advantage of 80% bonus depreciation.

Among its array of provisions, the extension of 100% bonus depreciation emerges as a cornerstone, designed to spur investment in machinery, equipment, and.

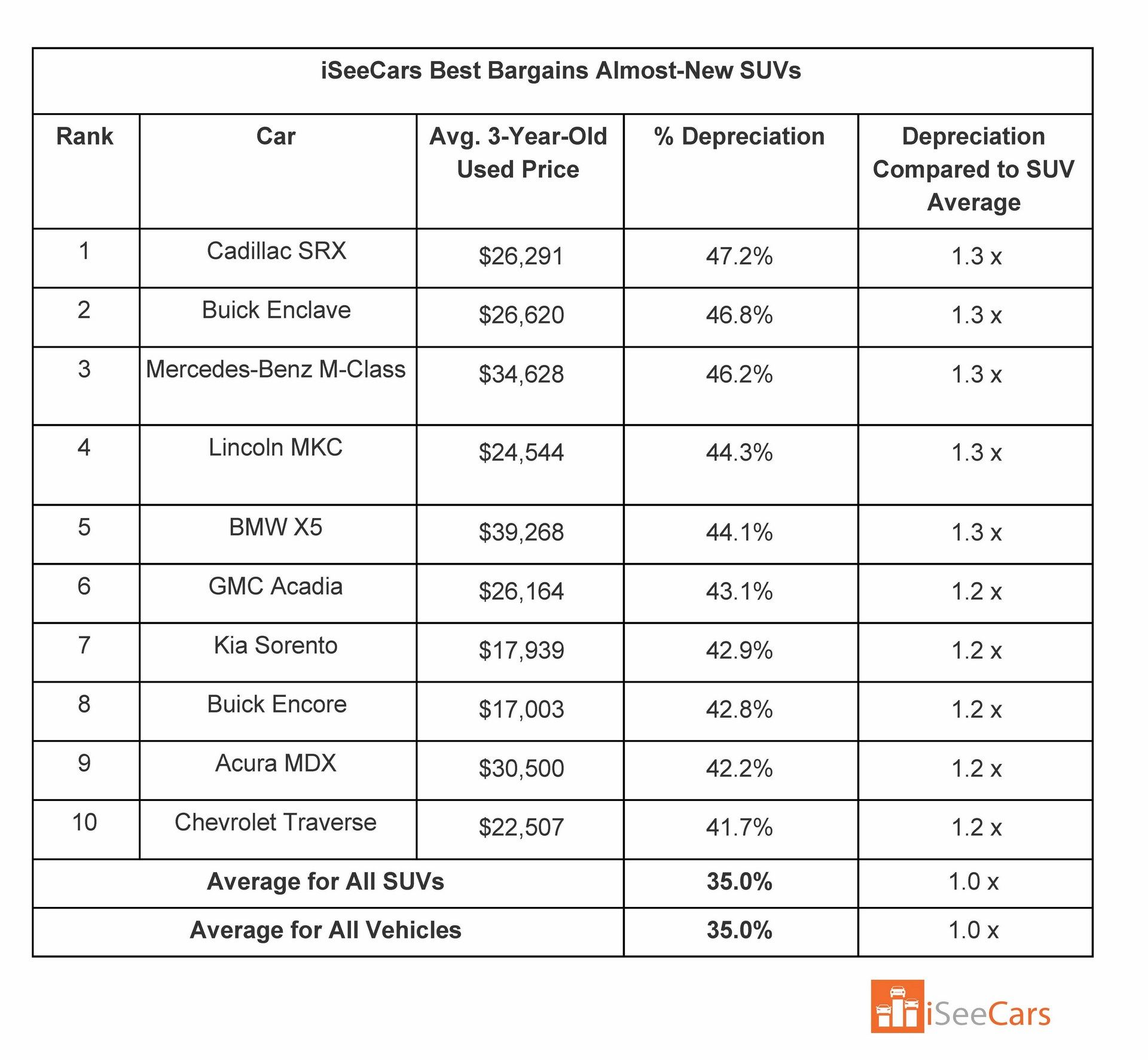

In The Market For A Used Car? Check Out The Models With The Highest, 0% how does bonus depreciation work? $12,400 for the first year without bonus depreciation.

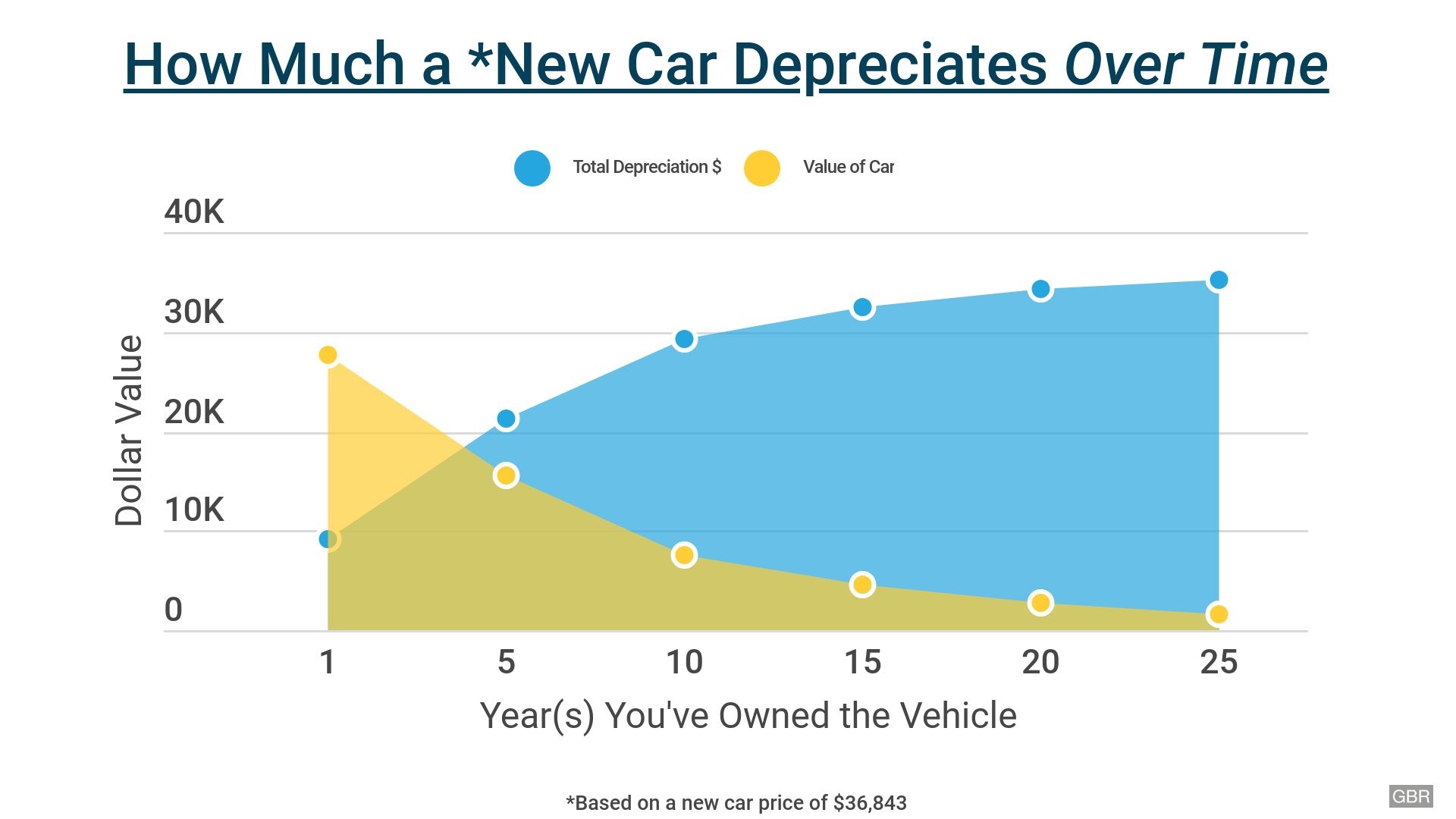

How Much a New Car Depreciates Over Time GOBankingRates, The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service. For 2025, that rate is $0.655 (65 cents) per mile.

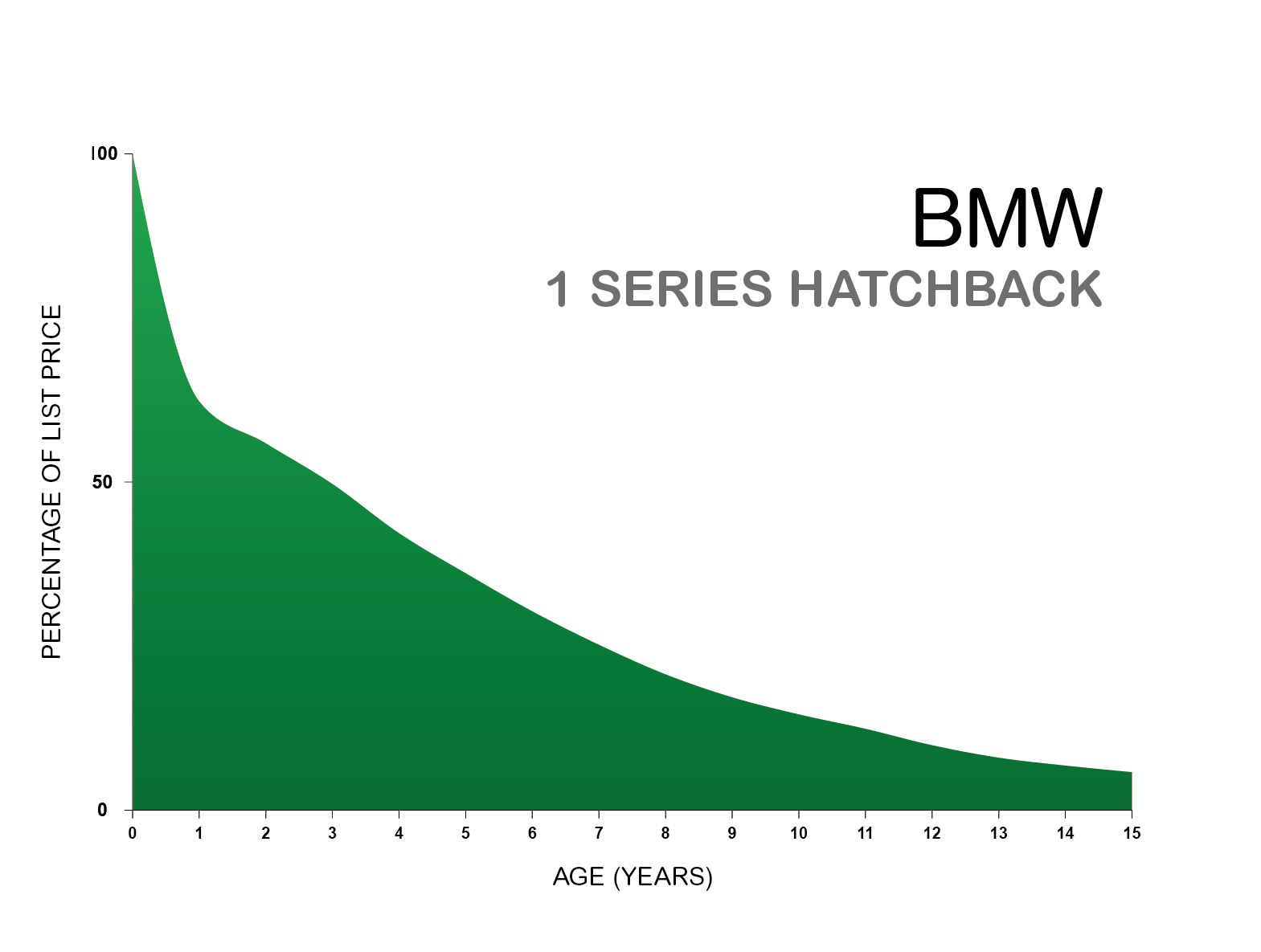

BMW 3 Series Depreciation How to Avoid Losing Big in 2025, For passenger vehicles, trucks, and vans that are used more than 50% for business, the bonus depreciation limit was $18,100 for the first year for 2025. The luxury cardepreciationcaps for a passenger car placed in service in 2025 limit annual depreciation deductions to:

Commercial truck depreciation calculator JeannieElli, (1) two tables of limitations on depreciation deductions for owners of passenger automobiles placed in service by the taxpayer during. $7,500 total cash (customer cash), $750 (owner loyalty bonus) expires apr.

Car Depreciation Explained with Charts webuyanycar, (1) two tables of limitations on depreciation deductions for owners of passenger automobiles placed in service by the taxpayer during. Roxy does not take a sec.

Easy Way to Calculate Car Depreciation, Luxury car depreciation cap rules and listed property depreciation rules. For passenger vehicles, trucks, and vans that are used more than 50% for business, the bonus depreciation limit was $18,100 for the first year for 2025.

Bonus Depreciation Phase Out Financial, The luxury cardepreciationcaps for a passenger car placed in service in 2025 limit annual depreciation deductions to: 0% apr for 60 months.

What is Car Depreciation? Holts, The luxury car depreciation caps for a sport utility vehicle, truck, or van placed in service in 2025 are: Bonus depreciation works by first purchasing qualified business property and then putting that.

Bonus Depreciation Example and Calculations Financial, $12,400 for the first year without bonus depreciation. $12,400 for the first year without bonus depreciation.

8 ways to calculate depreciation in Excel (2025), For 2025, businesses can take advantage of 80% bonus depreciation. For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of.

The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service.

The luxury car depreciation caps for a sport utility vehicle, truck, or van placed in service in 2025 are: